Bengt J. Olsson

Twitter: @bengtxyz

LinkedIn: beos

Introduction

Model

Results

Conclusions

Update 2023-12-02

Introduction

Offshore wind power and nuclear power are both complex and costly animals. Both are proposed to provide power in bulk to many regions. Just based on LCOE for each power type, offshore wind power has the upper hand based on a slightly lower LCOE in general. But what happens if we try to include balancing costs as well? That is, when we need to provide backup power when the wind is not blowing or nuclear reactors go offline. Who then provides the lower system LCOE?

Model

To investigate this we set up a simplified model. We use a projected consumption case for Germany 2040, given by this report. Shortly consumption can be divided into a “legacy” part of 811 TWh and a hydrogen production part consuming 131 TWh resulting in an energy need of 942 TWh yearly. We assume a seasonal variation of ±15 GW and a similarly sized daily variation. (The latter is less important since the balancing needs are dictated by the seasonal variation anyway). All energy must be supplied by the chosen power source, offshore wind or nuclear power. No import/export is allowed.

In both cases we model a fixed size hydrogen storage of size 100 TWh (measured in power to produce the hydrogen, the corresponding H2 LHV value would be around 67 TWh). This is quite a typical value can be found in reports for the storage size needed for hydrogen in a future Germany. We will keep this value fixed in both optimizations but we will vary the values for a) the electrolyzer capacity needed for producing hydrogen both for “external” delivery for the industry and for power balancing purposes, and b) the hydrogen CCGT capacity needed for power balancing. The round-trip efficiency power -> hydrogen -> power is chosen to be 40%.

Thus, there will be three parameters to vary for each case: (offshore wind or nuclear power production, electrolyzer capacity, H2 CCGT capacity). These values are processed through an optimization algorithm that finds a system with the lowest annualized cost, subject only to the condition that no deficit shall occur. The other (fixed) system parameters are given according to the table below.

| Component | CAPEX (overnight cost) | OPEX (yearly cost) | Lifetime | Capacity factor | Discount rate | LCOE |

|---|---|---|---|---|---|---|

| Offshore Wind power | 2.5 BUSD / GW | 3% of CAPEX ( 75 MUSD / GW / year ) | 25 y | 53% | 6% | 58.3 USD/MWh |

| Nuclear power | 5 BUSD / GW | 3% of CAPEX + 1 cent/kWh fuel cost ( 229 MUSD / GW / year ) | 60 y | 89.7% | 6% | 68.5 USD/MWh |

| Hydrogen Storage | 2 BUSD / TWh 1 | 2% of CAPEX ( 40 MUSD / TWh / year ) | 40 y | N/A | 6% | N/A |

| Electrolyzer capacity | 0.5 BUSD / GW | 3% of CAPEX ( 15 MUSD / GW / year ) | 25 y | N/A | 6% | N/A |

| Hydrogen CCGT capacity | 0.75 BUSD / GW | 2% of CAPEX ( 15 MUSD / GW / year ) | 25 y | N/A | 6% | (see caption) |

1) The cost for the hydrogen storage is lowered to 1 BUSD/TWh in the “Update” section. This may be more in line with costs for large salt caverns and/or depleted gas fields.

Finally, the total cost for the whole system is obtained and annualized using the lifetime and discount rate. The system LCOE is then calculated as this total annualized cost divided by the “useful” energy output, that is the 942 TWh per year of normal consumption plus the hydrogen production for external use.

Offshore wind power production data is taken from ENTSO-E for Danish offshore wind power for the years 2020-2022. It is normalized to conform to the 2022 year level. 53% capacity factor is taken from the Danish “Analyseforudsætninger til Energinet” averaged over their offshore wind power plants 2040.

Nuclear is modeled as 90 reactors with the same constant power output. This output is the parameter that is varied to get a cost-optimal solution, it will become close to 1.35 GW. The variation in total output power will not depend on this level, since it is fixed and the same for all reactors, instead a Markov model is used with random online-offline periods that provide the variation in total output power. This fixed capacity per reactor plus total output energy corresponds to a capacity factor of 89.7% for nuclear power.

Note that the model fully utilizes hydrogen production flexibility. That is, during power deficits hydrogen production is decreased and hydrogen is delivered from the store instead.

Results

Offshore wind power alternative

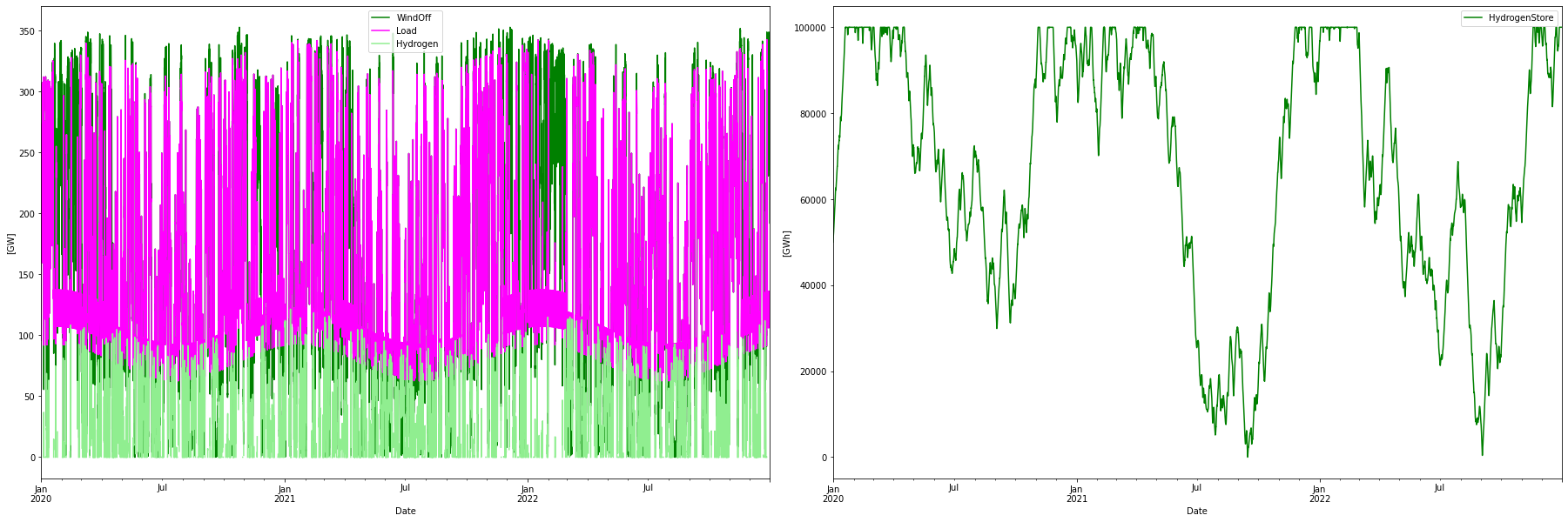

First let’s look at the offshore wind power capacity alternative, that is serving 942 TWh with only offshore wind power, using hydrogen CCGT for balancing. The power dispatch and hydrogen store levels looks like this:

Consumption per year: 1340.73 TWh

Consumption H2 per year: 529.69 TWh

Produced WindOff per year: 1367.44 TWh

Curtailed per year 179.50 TWh

Deficit per year -0.00 TWh

Hydrogen discharge per year 152.82 TWh

Max overshot: 246.14 GW

Max shortage: -0.04 GW

Installed Capacity Unit TWh/year CAPEX/GW(h) OPEX/MW(h)/y CRF Tot CAPEX Tot OPEX Ann Cost LCOE

WindOff 294.530 GW 1367.444 2.500 75.000 0.078 736.325 22.090 79.690 58.277

H2Store 100000.000 GWh 0.000 0.002 0.000 0.078 200.000 0.004 15.649 inf

H2Elys 221.698 GW 0.000 0.500 15.000 0.078 110.849 3.325 11.997 inf

H2CCGT 121.470 GW 152.816 0.750 15.000 0.078 91.102 1.822 8.949 239.47

Total over-night cost 1138.3 GUSD

Total yearly OPEX costs 27.2 GUSD

Annualized cost 116.2852 GUSD

System LCOE 123.4406 USD/MWh

Energy balance:

Power in: 1367.4 (offshore wind) + 152.8 (hydrogen CCGT) = 1520.2 TWh Power out: -811.0 (normal consumption) -131.0 (hydrogen delivery) - 152.8/0.4 (hydrogen for CCGT) - 50.0/3 (store starting half full and ending full) -179.5 (curtailed) = -1520.2 TWh

The system LCOE ends up at 123 USD/MWh. This is much higher than the around 70 USD/MWh that is typically presented for new production. Overproduction and a large amount of backup capacity (more than 200 GW of electrolyzers and CCGT capacity) drive up the price.

Nuclear power alternative

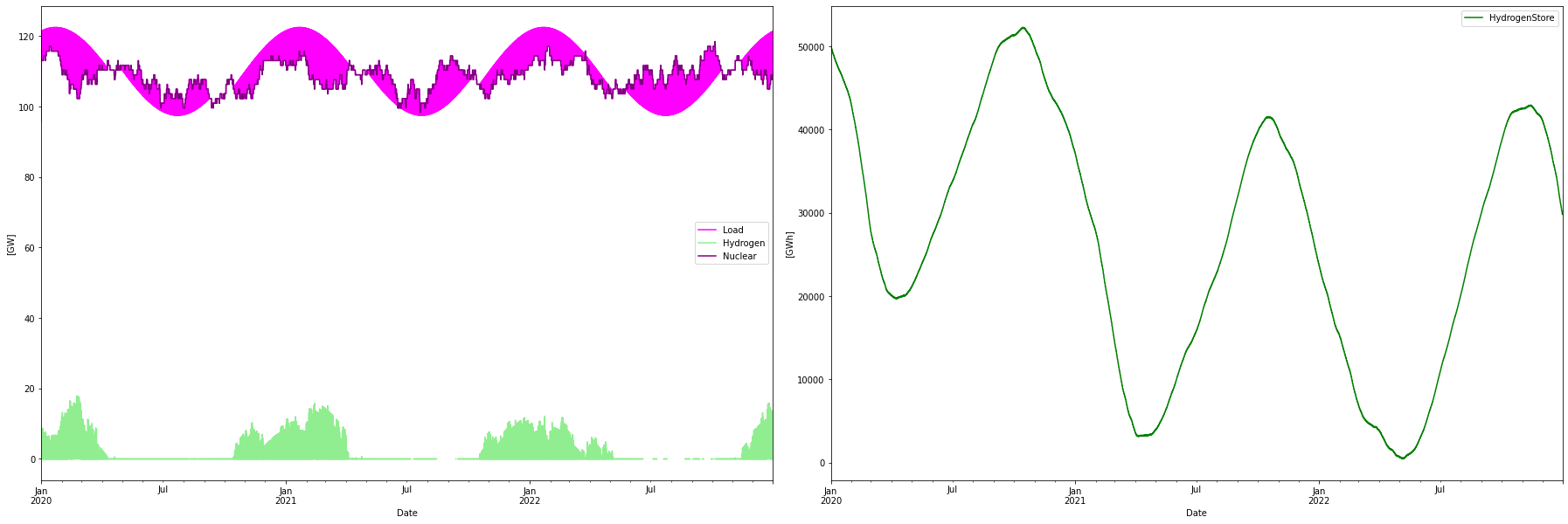

The corresponding dispatch for the optimal nuclear alternative looks like this

Consumption per year: 955.34 TWh

Consumption H2 per year: 144.30 TWh

Produced nuclear per year: 952.53 TWh

Nuclear capacity factor: 89.68 %

Curtailed per year 5.26 TWh

Deficit per year -0.00 TWh

Max overshot: 16.45 GW

Max shortage: -0.04 GW

Installed Capacity Unit TWh/year CAPEX/GW(h) OPEX/MW(h)/y CRF Tot CAPEX Tot OPEX Ann Cost LCOE

Nuclear 121.140 GW 952.534 5.000 229.000 0.062 605.700 27.741 65.219 68.469

H2Store 100000.000 GWh 0.000 0.002 0.000 0.078 200.000 0.004 15.649 inf

H2Elys 35.000 GW 0.000 0.500 15.000 0.078 17.500 0.525 1.894 inf

H2CCGT 17.903 GW 8.069 0.750 15.000 0.078 13.427 0.269 1.319 2337.6

Total over-night cost 836.6 GUSD

Total yearly OPEX costs 28.5 GUSD

Annualized cost 84.0814 GUSD

System LCOE 89.2550 USD/MWh

Energy balance:

Power in: 952.5 (nuclear) + 8.1 (hydrogen CCGT) = 960.6 TWh Power out: -811.0 (normal consumption) -131.0 (hydrogen delivery) - 8.1/0.4 (hydrogen for CCGT) + 20.6/3 (store starting half full and ending 20.6 TWh lower) -5.3 (curtailed) = -960.7 TWh

Lower production as well as balancing costs adds up to a much lower system LCOE of 89 USD/MWh. Less overproduction and small amounts of back-up capacity keep the cost lower.

Conclusions

Looking at the components LCOE alone, offshore wind power certainly has the upper hand, weighing in at 58.3 USD/MWh while nuclear costs 68.5 USD/MWh. But after accounting for balancing costs the nuclear alternative became very much more affordable at 89 USD/MWh vs 123 USD/MWh for offshore wind power. The three times higher power spans (350 GW vs 120 GW) that the all wind power scenario shows also implies a difficult system to manage with higher transmission costs as well as ancillary services costs. Transmission and system services are not part of this model.

Now this is of course a very simple model, but it aims to show that LCOE alone is not sufficient to determine the cost-effectiveness of a certain power technology, rather it is important to internalize the balancing costs as well.

Another conclusion is that both offshore wind and nuclear power are expensive, to optimize the system cost lower cost power sources should be added (until their balancing costs offset the savings by using these).

Both systems deliver power without deficit for their consumers and also provide a steady delivery of 131/8.76 = 15 GW of hydrogen to the industry as well. Note that the nuclear alternative only uses half the capacity of the hydrogen store, so it is possible to shave off some system LCOE if this capacity is lowered. And that is possible since it is the relatively steady load variation that determines its size. This is opposed to the wind-powered system where the storage size is determined by the weather pattern. The system is optimized for the weather pattern of 2020-2022 but if this changes for the worse (as it certainly will for some three years…) a larger storage will be needed instead, with increased system LCOE as a result.

Update 2023-12-02: Overproduction in the nuclear power only case

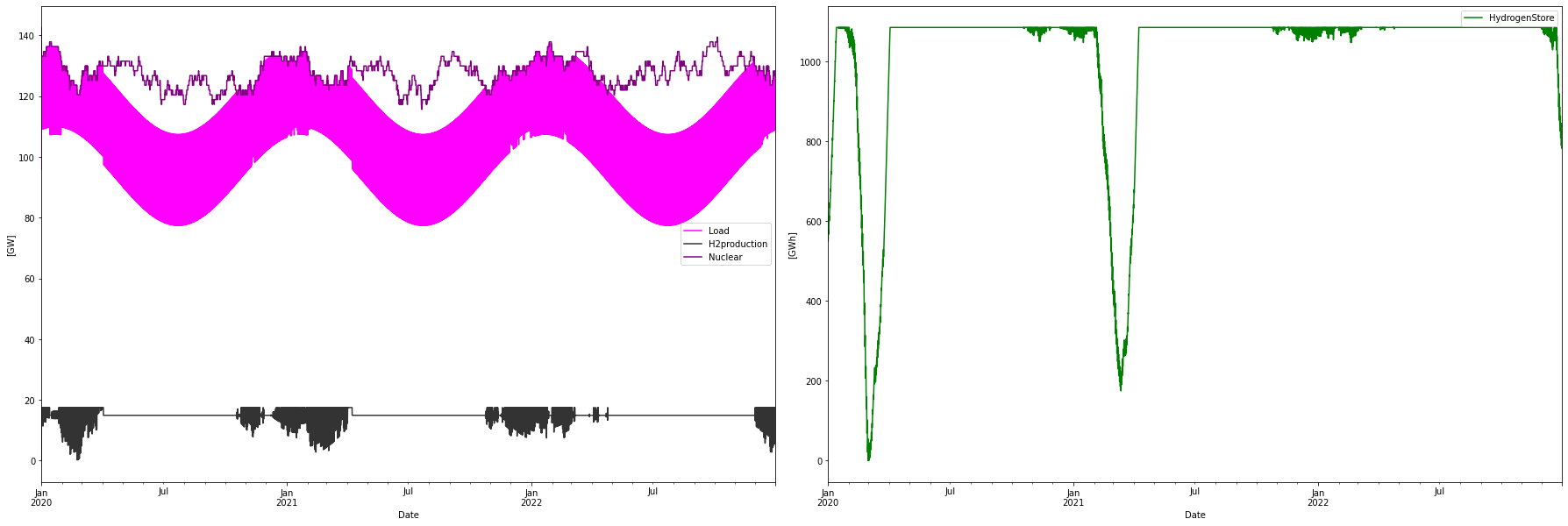

By removing the condition for fixed-size storage, optimization of the nuclear-only case led to a very interesting result. The total system cost was minimized by eliminating the hydrogen CCGTs and shrinking the storage from 100 TWh to 1.1 TWh, which is a 99% reduction of the storage. Also, the electrolyzer capacity was halved from 35 to 17.5 GW, meaning that the electrolyzers now work at a high 85% capacity factor.

All this was enabled by increasing the power of each reactor slightly from 1.35 GW to 1.585 GW. This leads to an overproduction of power, minimizing the need for hydrogen production flexibility and CCGT backup capacity. The power dispatch and storage looks like:

Consumption per year: 942.11 TWh

Consumption H2 per year: 131.07 TWh

Produced nuclear per year: 1121.67 TWh

Nuclear capacity factor: 89.68 %

Curtailed per year 179.54 TWh

Deficit per year 0.00 TWh

Max overshot: 56.83 GW

Max shortage: 0.00 GW

Installed Capacity Unit TWh/year CAPEX/GW(h) OPEX/MW(h)/y CRF Tot CAPEX Tot OPEX Ann Cost LCOE

Nuclear 142.650 GW 1121.669 5.000 229.000 0.062 713.250 32.667 76.800 68.469

H2Store 1100.000 GWh 0.000 0.002 0.000 0.078 2.200 0.000 0.172 inf

H2Elys 17.500 GW 0.000 0.500 15.000 0.078 8.750 0.263 0.947 inf

Total over-night cost 724.2 GUSD

Total yearly OPEX costs 32.9 GUSD

Yearly net exchange costs 0.0 GUSD

Annualized cost 77.9190 GUSD

System LCOE 82.7135 USD/MWh

We can see that the system LCOE is now down as low as 83 USD/MWh. The system curtails more or less the same amount as in the offshore wind power only case.

Thus, a slight overproduction of nuclear energy provides a very simplified system, without the need for hydrogen CCGT backup power capacity and only needing a small buffer store for continuous delivery of hydrogen to the industry. This to a much lower cost than for a much more complex offshore wind-only system.

From the figure above it could be seen that the overproduction is to a large extent “deterministic” with most overproduction in the summer due to a lower demand. This determinism could be used in for example providing export PPAs with advantageous pricing during the summer seasons. This is instead of curtailing the energy if it can’t be exported on the day-ahead market.

Of course, considering that this is a very hypothetical model, I would still say that the nuclear overproduction case provides a very interesting system solution. It is not a waste, since the total cost is minimized by this overproduction. For a country without large-scale hydropower that can handle balancing, or for countries without the possibility (or not want…) to implement multiple TWh of hydrogen storage, this could be an interesting (and cost-effective) solution. But there is a need for a hydrogen industry since most of the flexibility relies on this hydrogen production.

—

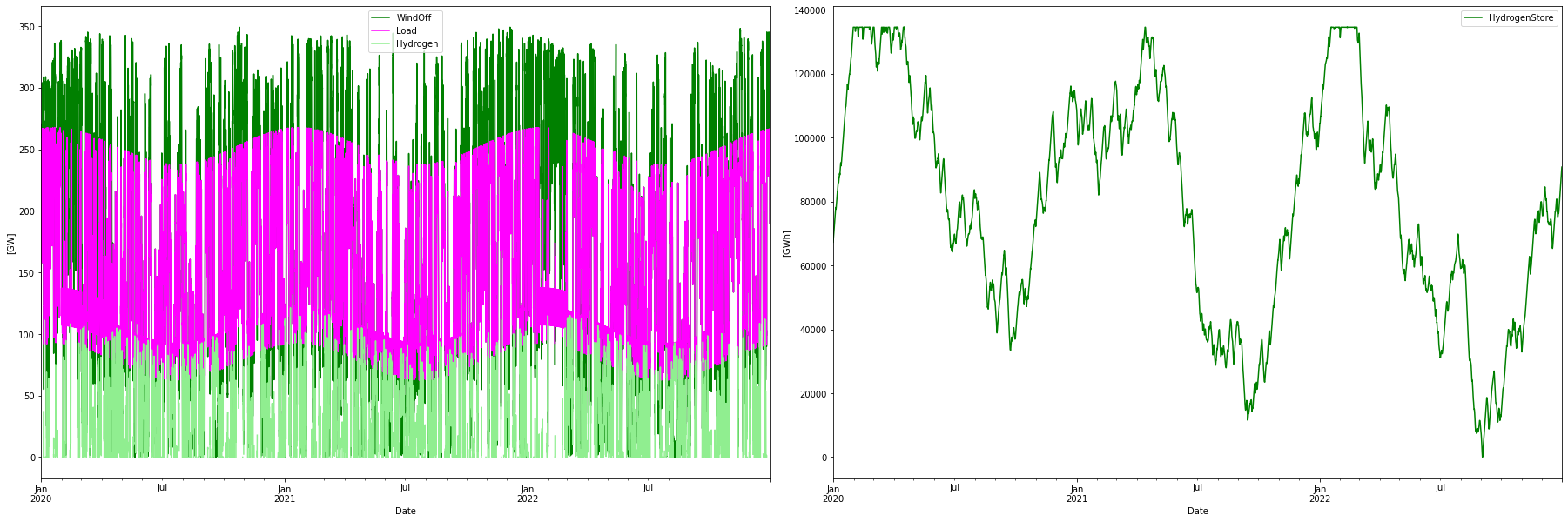

I also took the plunge to fully optimize the offshore wind power-only case as well, by also varying the hydrogen store size. Also lowered the cost of hydrogen storage from $2 to $1 per kWh stored hydrogen. This would give a “rock bottom” system LCOE for offshore wind power alternative at 113 USD/MWh, now with a 135 TWh hydrogen storage but less electrolyzer capacity at 145 GW, and about the same amount of hydrogen CCGT capacity.

113 MUSD/MWh is however still vastly more expensive than the 83 MUSD/MWh for the optimized nuclear-only case. The latter will also have lower costs for transmission and system stability measures.